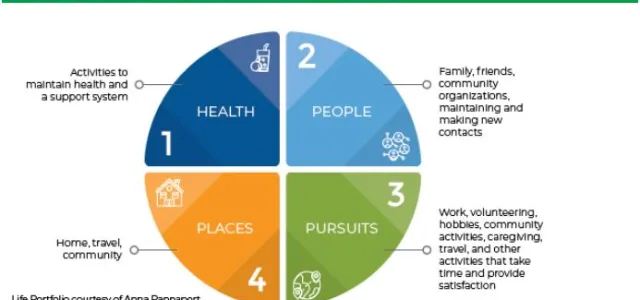

While you and your trusted retirement professional will work to create an overall retirement strategy, this does not mean that you won't need to make changes

Early retirement may seem like a dream come true. However, you need to be well prepared if you want to retire early. If you’re not prepared, you might run into

Retirement is an exciting life milestone that requires careful planning and budgeting. For military families, it requires even more knowledge, because you need

Parents and grandparents of high school students have a wistful feeling about the child they’ve watched grow up, as well as a concern for what lies in their

Let's admit it: Planning for taxes is not the most fun activity. There are likely (many) other things you would rather be doing. But accurate tax planning is

It's never too early to start looking at your tax obligations for the coming tax season. The information in this article is for the 2023 tax year, which most

Rushing to file your tax return before the deadline may mean making mistakes that could have been avoided. Even now, there is still plenty you can do to plan

Between gathering the necessary paperwork and working through complicated scenarios, tax season can be a stressful time. You’ve worked hard throughout the year

Losing a job is tough, especially when it's by no fault of your own. In the event that you find yourself unexpectedly without a stream of income, you may be